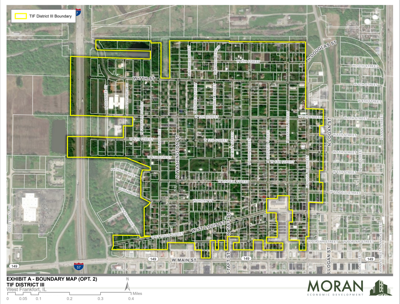

WEST FRANKFORT, Ill. (WSIL) -- West Frankfort is working on a new initiative to revitalize its neighborhoods through a residential tax increment financing (TIF) district.

This third district, approved by the city council, focuses on residential areas with the most vacant or distressed infrastructure.

City officials explained the purpose of this TIF district is to promote and support redevelopment in areas of West Frankfort that are declining or in need of improvements. The city plans to capture increases in property tax revenue and allocate them to the TIF.

Residents or developers interested in rehabilitating properties or building in the district can apply to receive funding from the TIF to help finance their projects.

A public meeting was held to gather input from homeowners. Some expressed concerns about potential tax increases. Moran Economic Development, the company leading the proposal, pointed out that making improvements can raise property values, potentially leading to higher taxes.

Mayor Tim Arview shared that successful residential TIFs in other cities, like Marion, inspired the council to consider this approach for West Frankfort.

He emphasized that the TIF does not directly raise property tax rates but redirects tax revenue increases to fund new construction and rehabilitation projects.

"When you see that number go up on the TIF line item, it's actually not going up on another line item that it would have it TIF wasn't there," said Mayor Arview. "It's kind of a misconception that TIF raises your property taxes. It doesn't."

The residential TIF program is not yet active and would begin next year if adopted by the city council. Details of the plan are available on the city's website.