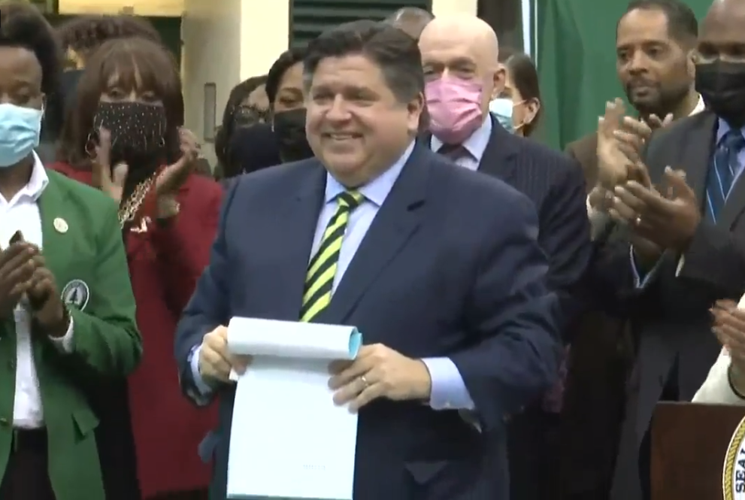

(WSIL) --ÌıGovernor JB Pritzker signed the fiscal year 2023 budget into law Tuesday morning.Ìı

The budget includes new funding for education, human services, law enforcement and violence prevention.Ìı

âThe budget Iâm signing into law today brings real improvements to the lives of working families and sets us up for a stronger fiscal future,â�Ìısaid Governor JB Pritzker. âInvestments in stronger schools, modernized airports and newly paved highways, hundreds of thousands of well-paying infrastructure jobs, and a better funded pension systemâ� these are the kind of priorities we can invest in when our state is governed responsibly.â�

âThis is the most responsible budget a governor of either party has signed in Illinois in decades,â� Comptroller Susana A. Mendoza said. âThis is the result of years of hard work, with my office aggressively paying down the stateâs unpaid bills for the last five years and the governor and legislators making wise choices not to spend all the money the state gets, but rather putting some aside to cover potential problems in the future.âÌ�

OVERVIEW

The fiscal year 2023 General Funds budget plan reflects projected revenues of $46.429 billion and expenditures ofÌı$45.986 billion, resulting in aÌı$444Ìımillion surplus.

The fiscal year 2023 budget also directs federal dollars received from the American Recovery Plan Act (ARPA) to aid businesses, healthcare providers and families, and invest in Illinois' communities.

Highlights from the budget package include:

Household incentivesÌıÌı

- Suspends grocery tax for one year

- If you were to spend $100 a week on groceries, you would save $1 on your bill.

- Freezes the motor fuel tax for six months

- If you were fueling up, you also might save about $1 a month, if you fill up once a week.

- Provides $520 million for a one-time property tax rebate â� 5% of property taxes paid, up to $300 per household

- Permanently expands the earned income tax credit from 18 to 20 percent of the federal credit while expanding the number of households covered

- Provides $685 million for direct rebate checks to working families

- $50 per individual

- $100 per dependent, up to three children per family

- Income limits: $200,000 for individuals and $400,000 for joint filers

- Provides families with a âBack to Schoolâ� sales tax holiday on clothing and school supplies for a week in August and doubles tax credit for teachers who buy classroom supplies

How would Illinoisans be impacted by proposed grocery, gas, & property tax breaks?

Fiscal Management

- Using ARPA funds for a $2.7 billion repayment of federal advances to the Unemployment Insurance Trust Fund

- Contributes $1 billion to the Budget Stabilization Fund (BSF) across FY2022 and FY2023Ìı

- Eliminates the payment delays in the employee and retiree health insuranceÌıprogram through $898 million in FY2022 supplemental appropriations.

Public Safety/Violent Prevention

- Approximately $1 billion for violence prevention, youth employment, and diversion program appropriations

- 300 new State Police troopers

- $240 million for the Reimagine Public Safety Act

- $30Ìımillion to support the Violent Crime Witness Protection ProgramÌı

- $30 million for Local Law Enforcement Body Camera grants

- $20 million for less lethal device grants and associated training expenses

- $8 million for a multi-year equipment replacement program at the Illinois State Police that includes radios, body and car cameras and cloud storage

Education

- $350.2 million increase for Evidence-Based Funding (EBF) for K-12 schools

- $96 million increase for transportation and special education district reimbursementsÌı

- $54.4 million increase for Early Childhood Education

- A 5 percent operating budget increase to Public Universities and Community Colleges in fiscal year 2022 through supplemental appropriations and a continuation of the 5 percent increase in fiscal year 2023

- An increase in funding for minority teacher scholarships

Health Care/Mental Health/Social Service

- $240 million in hospital tax relief through additional support to the Hospital Provider Fund

- Includes hundreds of millions in grant funding for safety net hospitals and other hospitals in Illinois from General Revenue Fund (GRF) and federal COVID-19 assistance dollars

- Waives licensing fees for nearly 470,000 frontline healthcare workersÌı

- Sets aside $180 million to preserve and expand the healthcare workforce, through Medicaid providers, focusing on underserved and rural areasÌı

- Creates the $25 million Pipeline for the Advancement of the Healthcare (PATH) Workforce grant program through the Illinois Community College Board, to train andÌıprovide support to students entering high demand healthcare professions

- Includes a $7.8 million increase in state support to Nurse Scholarships and Grants in our Higher Education institutions

- Increases funding by approximately $230 million to mental health care and community-based substance use disorder treatment providers

- Provides funding to fully implement the Pathways to Success Program for children with serious mental illnesses

- Creates the appropriation framework for the first year of funding from the National Multi-State Opioid Settlement agreement for prevention, treatment, and recovery services

- Allocates $70 million to implement the 9-8-8 Call Center and Crisis Response for individuals experiencing a mental health crisis

- Provides $14 million for January 1stÌırate increase for Department on Agingâs Community Care Program and funds continued higher levels of home-delivered meals for seniors.

- Sets aside $250 million to hire additional Department of Children and Family Services (DCFS) staff, increase rates for DCFSâ� private partners and create new residential capacity.ÌıÌı

- Provides an additional $90 million to the state'sÌıLow-Income Household Energy Assistance Program (LIHEAP)

Business Support/Environmental Support

- One-year waiver of retail liquor license fees to aid restaurants, bars, and liquor license holdersÌı

- $38 million to Employer Training and Investment Program

- $5 million to develop minority entrepreneurship programs and support small, minority-owned businessesÌı

- $20 million in grant funding for business attraction and retention

- Expands eligibility for the Reimagining Electric Vehicles in Illinois (REV Illinois) credit to battery recyclers, hydrogen and solar powered vehicles, and makers of their component parts.

- Funds $18.5 million in electric vehicle consumer rebates at the Illinois Environmental Protection Agency (IEPA)

- Continues funding for enforcement of the Clean Air Act and the Energy Transition Act at IEPA

- Includes $30 million for the Department of Central Management Services (CMS) to jump-start conversion of the state government vehicle fleet to zero emission vehicles and to deploy electrical charging infrastructure throughout Illinois

- Reappropriates $70 million from Rebuild Illinois at IEPA for transportation electrification and charging infrastructure statewide

Capital Funding

- Provides continued utilization ofÌı$1 billion in ARPA funds to cash-fund critical water and sewer infrastructure projects and for statewide broadband, including Connect IllinoisÌı

- Fully funds the fiscal year 2023 Road Program at an estimated $3.76 billion

- Provides $9.1 million to IEPA for the first year of IIJA funds to promote energy efficiency, conservation, and state energy programs.

- Allows IDOT to capture nearly $150 million in formula funds through IIJAâs National Electric Vehicle Infrastructure Formula Program to support the expansion of an EV charging network in the state.

- Includes $30.2 million to address cybersecurity risks and threats.

American Rescue Plan Act (ARPA)

Appropriates the remaining $4 billion in federal American Rescue Plan Act funding, including the $2.7 billion deposited into the Unemployment Insurance Trust Fund (P.A. 102-696) and another $1.37 billion to a number of agencies in COVID-19 related response, including:

- $320 million in state COVID-19 response operational appropriations for Illinois Emergency Management Agency ($200 million), Department of Corrections ($50 million), Department of Human Services ($50 million) and Department of Public Health ($20 million)

- $380 million in pandemic support healthcare provider payments

- $225 million for Nursing Homes

- $67 million for Hospitals

- $30 million for Ambulances

- $58.7 million to support safety-net hospitals through DPH

- $235 million (plus $5 million GRF) to support violence prevention grants through Reimagine Public Safety Act

- $150 million for affordable housing programs through the Illinois Housing Development Authority

- $83.4 million for violence prevention and interruption grants at Criminal Justice Information Authority (CJIA)

- Support for industries impacted by the COVID-19 Pandemic through DCEO:

- $75 million for a hotel jobs recovery program

- $50 million for restaurant employment and stabilization grant program

- $50 million for arts-related grants such asÌılive venue operators, performing or presenting arts organizations, arts education organizations, and museums or cultural heritage

- $15 million for tourism attraction development grants